How to make a million*, and what we should do to stop you.

(*Probably)

By John Armstrong, Senior Lecturer in Financial Mathematics,

King's College London

The dream for a rogue trader is to come up with a trading

strategy that requires no up-front investment

and that makes an arbitrarily large profit almost all of the time.

A rogue trader doesn't really care if they very occasionally make

a catastrophic loss, because, chances are, they won't have to pick up the pieces.

They like to leave that to the rest of us.

The dream for a rogue trader is to come up with a trading

strategy that requires no up-front investment

and that makes an arbitrarily large profit almost all of the time.

A rogue trader doesn't really care if they very occasionally make

a catastrophic loss, because, chances are, they won't have to pick up the pieces.

They like to leave that to the rest of us.

If are a rogue trader, then the the good news is that

there is such an investment strategy. Even better,

the regulators think it is risk free, so it is perfectly legal.

If you are a regulator, then the bad news is that the tools you are

using to measure risk are flawed and will be ineffective in curbing the

behaviour of rogue traders. Fortunately, there are

some alternative ways of measuring risk which are effective, which

you might want to adopt.

Value at Risk

One of the standard measures of risk in the industry is called Value at Risk.

This uses probability levels to work out risk.

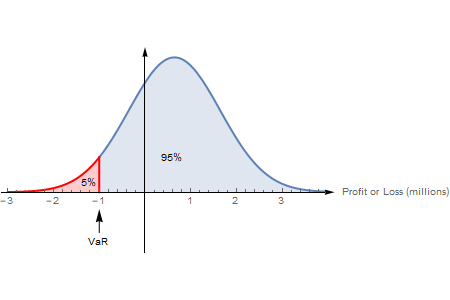

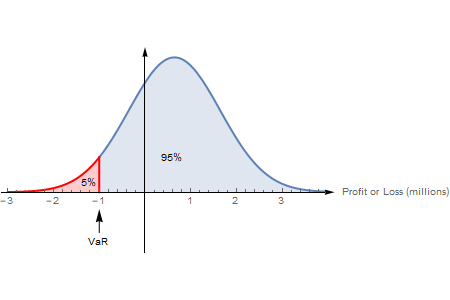

For example, if the probability of you losing $1 million or more

is 5%, then your 5%-Value at Risk is $1 million.

Example: A profit and loss distribution where the 5%-Value at Risk (VaR) is $1 million

Example: A profit and loss distribution where the 5%-Value at Risk (VaR) is $1 million

The problem with this way of measuring risk, is that it ignores

the risk in the tail of the probability distribution.

For example, if you never lose money, but 5% of the time you break

even, your 5%-Value at Risk will be 0. If you lose $100 million 1%

of the time, and break even 4% of the time, your 5%-Value at Risk will also

be 0. The large loss of $100 million is in the far left tail of the distribution

and is ignored by the value at risk.

This theoretical problem with Value at Risk can easily be exploited by

traders in the derivatives market. The main purpose of derivatives trading

is that it allows traders to carefully choose the distribution of risks they

are taking to match their risk preferences. This is a good thing, if the

trader's risk preferences are to make a reasonable return without taking on too much

risk. However, if the trader's preferences are to make an enormous return most

of the time, and not to worry about the occasional catastrophic loss, then there

is a problem. Traders can use derivatives to come up with

investment strategies that cost nothing to set up, have a 5%-Value at Risk

and have an arbitrarily large upside. Of course, in the worse 4% of scenarios,

these investment strategies do disastrously.

This is the rogue trader's dream,

and it shows that value at risk limits are ineffective.

Expected Shortfall

It might

seem obvious with hindsight that pre-crisis bankers were hiding the true

risk of their investments from the regulators and even from themselves.

But surely we have learned from our mistakes?

We certainly have learned a little. Value at Risk is no longer the industry

standard. Regulators now use a new risk measure called expected shortfall

which estimates the risk as the average loss in the tail. Unfortunately

if you are society (or fortunately if you are a rogue trader),

expected shortfall has the same problem. It is possible to

use derivatives to create investment strategies that cost nothing to set

up, have an expected shortfall of zero and have an abitrarily large

upside.

Again this is the rogue trader's dream.

It shows that expected shortfall limits are ineffective. So much

for learning from experience.

How much should we worry?

Our results are mathematical. We haven't tried using the trading strategies

we have found in practice, and we don't want to. There would probably be

some practical difficulties in actually carrying our strategy.

However,

the regulation should be strong enough to ensure that banks and traders cannot take on

excessive risk. It shouldn't be necessary to rely on the practical difficulties

of implementing a trading strategy as our only safeguard against these risks.

One thing the financial markets are good at is devising new financial products

that allow people to manage risk and exploit opportunities in the market. This

is the entire point of the derivatives industry. When used as a tool to make

investments more efficient, the development of new financial products is

a very good thing.

However, complex derivatives such as the

collateralized debt obligations that were popular before the 2008 financial

crisis can easily be used to hide risk in the tail. The creativity

of the financial markets is double-edged and needs careful regulation.

We now know that the tools we use to measure risk are flawed, so you

can bet that

traders will seek a way to exploit this. We shouldn't wait around

to see what happens when they succeed.

What can we do?

It's simple. Instead of taking the average

loss, you can take a weighted average so that you see a 1% chance of loss of $5 million

as being worse than a 5% chance of a loss of $1 millon and a 0.1% chance of a loss

of $10 million being even worse again. Mathematically this is easy to do,

and this simple change fixes the problem.

If regulators take up this idea, it may finally mean we have some bad

news for rogue traders.

References

-

J. Armstrong and D. Brigo. Risk managing tail-risk seekers: VaR and expected shortfall vs S-shaped utility.

Journal of Banking and Finance 2019. Link

-

J. Armstrong and D. Brigo. Statistical Arbitrage of coherent risk measures.

Working paper. Arxiv

The dream for a rogue trader is to come up with a trading

strategy that requires no up-front investment

and that makes an arbitrarily large profit almost all of the time.

A rogue trader doesn't really care if they very occasionally make

a catastrophic loss, because, chances are, they won't have to pick up the pieces.

They like to leave that to the rest of us.

The dream for a rogue trader is to come up with a trading

strategy that requires no up-front investment

and that makes an arbitrarily large profit almost all of the time.

A rogue trader doesn't really care if they very occasionally make

a catastrophic loss, because, chances are, they won't have to pick up the pieces.

They like to leave that to the rest of us.